Phone Vince on: 021 438 952

Debt or Not to Debt?

This is an age-old question that every Council, and homeowner goes through every year, either when they are looking at their mortgage payments or looking at new investments or even considering a long-term plan.

All agree there is a fine line that is walked, and right now the interest rates are so low, there is very little discouragement to not borrow more, however the one thing that is controlling our debt level is how well we can service this debt. For a Council it is our ratepayers, who end up serving this debt, and the discussion that then needs to be had, is how much debt can you the ratepayer pay, knowing full well that there are some people who are on the “bones of their arse” and there are some who earn more money in a week then most earn in a year.

What can be done? Is commercial investment and development something that Councils should be looking at? What am I highlighting, is sometimes Councils get more money within a year, due to faster than expected growth, and these funds can be used to reduce debt or transferred to another form of investment. Up to date, the Whangarei District Council has only put money from the sale of commercial land into other commercial land within their district, however, could this money be used in other areas of New Zealand as investments with the benefits funding Whangarei.

There are also Councils around the world, which take the money from extra development into their district, and channel it into investment opportunities outside of their district, so that their own district can reap the rewards. Which does mean a bit of a two-prong benefit, that their own ratepayers end up with less of a burden, and they also get more money with more investments.

Far North Holdings, a CCO setup by the Far North District Council, does something very similar however at present it is focusing on construction projects that the FNDC cannot really do, or be hands on involved in. The Whangarei District Council has already created a CCO which looks after Northlands own landfill and resort centre, and the financial benefits do come back to the Whangarei ratepayers. So, is there a major hurdle to go further?

On the 27th of August 2020, all the District Councils were given the opportunity to turn Northland Inc. into a CCO of all Councils, however Whangarei District Council decided not to be part of this CCO. Northland Inc. is presently funded by the rates that go to the Northland Regional Council, with the vision of encouraging economic development within Northland. The Whangarei District Council puts in approx. $200k for the economic development of Whangarei District, and the proposal was asking over the next 6 years for Whangarei to put in $2.5m

Debt or not to debt? Should we be a District that creates more debt and use that debt to fund investments, or should we fund needed infrastructure, or should be get rid of debt as soon as possible, or should we maintain our debt level and work within our means? What is your view?

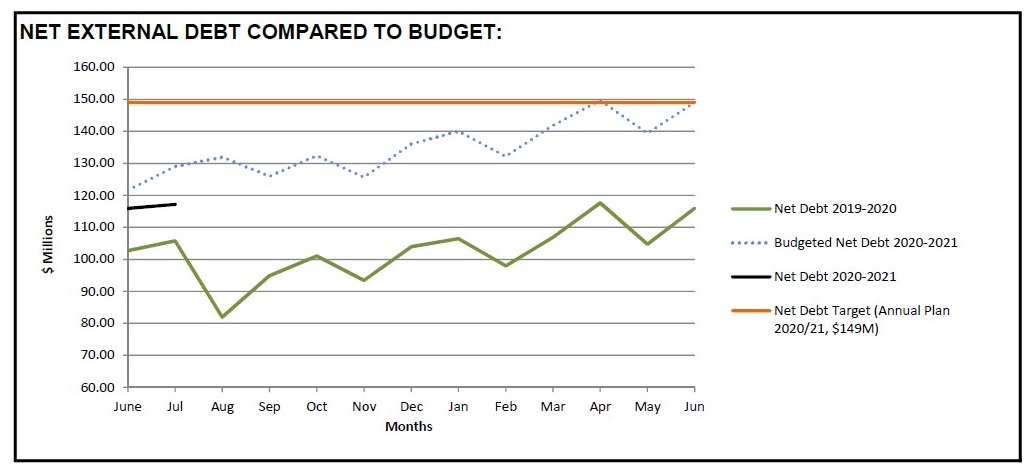

For reference, Whangarei District Council has a debt level of $152m with a population of approx. 96000 and rateable properties of 46000; the Kaipara District Council has a debt level of $67m with a population of approx. 21000; the Far North District Council has a debt of $89.7m with a population of approx. 69,000; and the Northland Regional Council has a debt of $0. Therefore, for the whole Northland with a population of approx. 186,000 the district has a total debt of $308.7m, which equates to $1,660 per person or approx. $3,500 per rateable property. Data collected from the Various District and Regional Council Annual Plans.

End.