Phone Vince on: 021 438 952

April 27 - Our District's Debt

We have all heard that our Council has too much debt, or does it? What about that so called internal Debt? Who is the LFGA? How much does Council owe them?

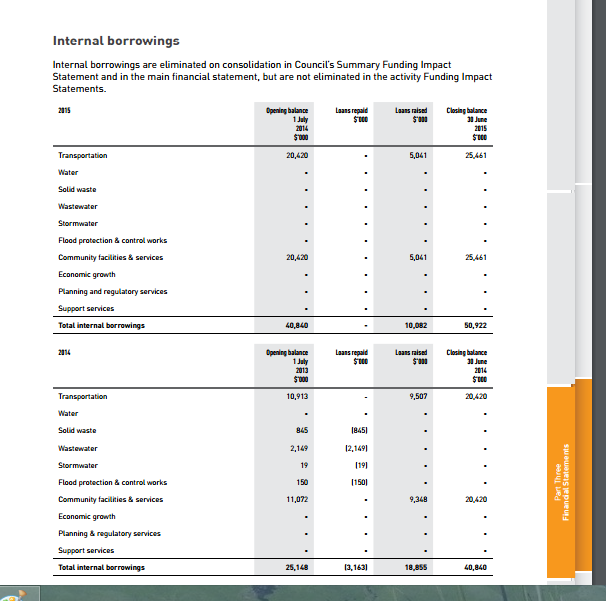

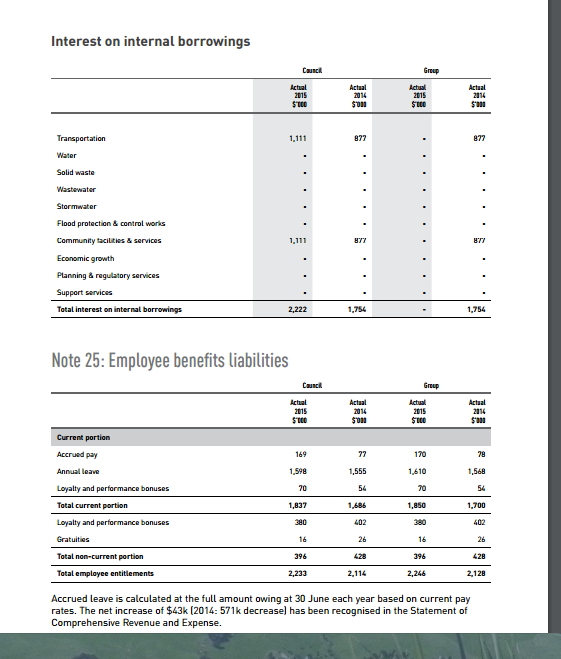

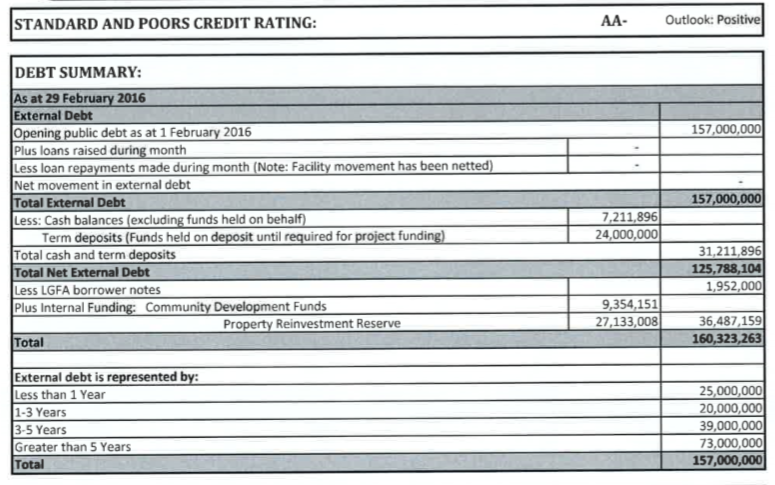

In June 2015 the Whangarei District Council had total internal borrowings of just under $51m. The WDC reported $36.5m in internal debt in February this year (2016). This sounds like a lot of money, and it is, but is there any interest being charged?

30 councils around New Zealand, including the WDC, use the Local Government Funding Agency (LFGA) as a type of bank. Various Councils have borrowed billions over the years since its launch in 2011. The LFGA is underwritten with 20% government money, so it is fairly secure. The LGFA is not a secret, but you have to accept a 1000-word disclaimer which references US and Australian law just to browse the website. So the LGFA is nothing to take lightly.

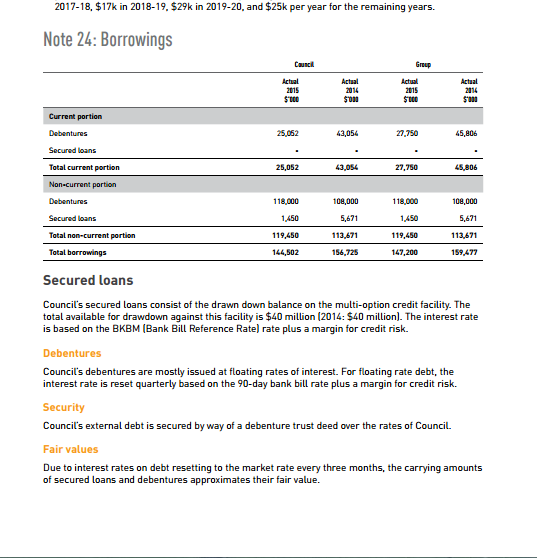

When the WDC borrow millions from the LGFA, they then pay hundreds of thousands of dollars a year in interest which doesn’t sound good. However favourable borrowing rates from LGFA also help save WDC hundreds of thousands of dollars.

According to the WDC, the LGFA enables shareholder councils “to use their combined asset bases to borrow at much lower interest rates than they can individually." This means WDC is helping other councils borrow, and other councils are helping the WDC borrow. While no council in NZ has ever defaulted on a debt, it’s a tad worrying that the collateral used to borrow is all the combined assets of all the member councils, which in turn means that we the people are responsible for this debt.

The WDC does say, if it does somehow default on a loan, no one’s going to take away a utility like a water treatment plant – but in WDC’s words, the initial $45m which was put in by nine of the largest councils provided LGFA with “a pool of money which it will keep as cash reserves to ensure risks are kept to an absolute minimum.” So if push comes to shove, the WDC could be hammered with some very large penalties if it can’t keep up with interest payments.

There are many ways Council can control the borrowing. Some of these methods include cutting back on spending, raising rates or going in investment opportunities with private partners, however there are risks in all of these.

What would you prefer - for councils to borrow more? Cut services? Do you want to pay more rates to help WDC pay its interest so it can keep borrowing? Or should we have more public-private partnerships? Perhaps all of the above?

BORROWING ACCOUNTS, FROM 2014-2015 ANNUAL REPORT:

BORROWING ACCOUNTS, FROM 2014-2015 ANNUAL REPORT: